Budget Direct Insurance Referral Code: Buddy82498 – Get Up to $80 Shopping Vouchers

We’re part of an international insurance group which provides insurance solutions for millions of policyholders worldwide.

Photo by Kindel Media from Pexels

Photo by Kindel Media from Pexels

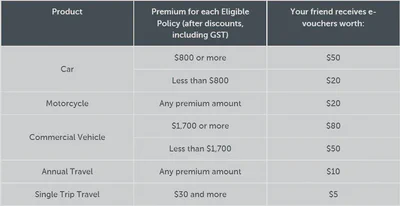

For first-time purchases of any travel, car, commercial vehicle, or motorcycle plan from Budget Direct Insurance, use the referral link or Buddy ID: Buddy82498 to receive up to $80 in shopping e-vouchers.

Based on personal experience, the shopping e-vouchers are typically redeemable at CapitaLand Malls. Voucher merchants may vary depending on the prevailing referral campaign.

Table of Contents

About Budget Direct Insurance

Affordable and Reliable Insurance in Singapore

Budget Direct Insurance is a direct insurer in Singapore offering competitively priced general insurance policies without unnecessary add-ons.

It is operated by Auto & General Insurance (Singapore) Pte. Limited (Co. Reg. No. 201626103G) and is licensed and regulated by the Monetary Authority of Singapore (MAS) as a Direct Insurer (General).

Budget Direct entered the Singapore market in 2016 and is part of an established international insurance group headquartered in the British Isles.

What Policies Does Budget Direct Insurance Offer?

Core products include:

- Car Insurance

- Commercial Vehicle Insurance

- Motorcycle Insurance

- Travel Insurance (Annual / Single Trip)

Notable Offerings

Commercial Vehicle Insurance

Budget Direct offers Commercial Vehicle Insurance with customisable coverage options. This may suit small business owners, contractors, and fleet operators seeking flexible protection.

Higher Risk Car Insurance

In April 2022, Budget Direct launched its Higher Risk Car Insurance, designed for drivers who may face difficulty obtaining standard car insurance in Singapore.

Key features:

- For drivers with 2 or 3 at-fault accidents and/or claims within the past 3 years.

- Named Driver Plan covering 1 Main Driver and up to 2 Named Drivers.

- Eligible drivers must be 30 to 75 years old with at least 5 years’ driving experience.

- Fixed policy excess of S$3,000.

- No-Claims Discount (NCD) Protector is not available.

⚠️ Note: The insurer may cancel the policy with 7 days’ notice if a second at-fault accident and/or claim is reported under the policy.

Why Choose Budget Direct Insurance?

1. Customer-First Approach

Budget Direct focuses on simplicity and value:

- No unnecessary extras bundled into policies.

- Competitive pricing through a direct-to-consumer model.

- Responsive customer support.

📢 Award-Winning Customer Service

Budget Direct has received the Feefo Platinum Trusted Service Award, an independent recognition based on verified customer reviews.

As of recent public records, Budget Direct Insurance has over 12,400 verified Feefo reviews, with an average rating of 4.7 out of 5 stars.

What is Feefo?

Feefo is an independent customer reviews platform that verifies feedback by linking reviews to genuine customer transactions.

2. Transparent and Affordable Pricing

- No agent commissions, which helps keep premiums lower.

- Direct purchase model reduces administrative costs.

3. Convenient Digital Experience

- Travel and motor claims payouts via PayNow

- Faster form filling using SingPass MyInfo

- SMS-based policy renewals available

4. Buddy ID Referral Programme

A Buddy ID is generated after purchasing a policy and can be shared with friends or family.

New customers who sign up using a Buddy ID may receive shopping e-vouchers, subject to prevailing referral terms.

💡 Tip: You may use your own Buddy ID for subsequent policies to earn additional e-vouchers.

Personal Experience with Budget Direct Insurance

Responsive Customer Support

In August 2022, I contacted Budget Direct to clarify whether an overseas relative could drive my insured vehicle. A customer service officer followed up promptly and assisted with the necessary updates.

Rebates for Claim-Free Drivers

During the call, I was informed that Budget Direct may offer small rebates to claim-free policyholders, credited back to the payment card, subject to eligibility and insurer discretion.

Early Renewal Incentives

Budget Direct has previously offered shopping voucher rewards for early renewals during selected campaign periods.

Final Thoughts: Is Budget Direct Insurance Worth Considering?

- Competitive premiums without unnecessary add-ons

- Strong independent customer reviews

- Fast claims payouts via PayNow

- Specialised Higher Risk Car Insurance option

💡 If you prioritise affordability, simplicity, and service quality, Budget Direct Insurance is worth considering.

📌 Learn more or request a quote at Budget Direct Insurance.

Public Service Announcement (PSA) on Motoring Touters and Insurance Fraud

This awareness message is shared by the General Insurance Association of Singapore (GIA) and Budget Direct Insurance.