UOB Credit Cards Sign-up Promotion

There’s a card for everyone.

We are tying up with SingSaver to present UOB credit card promotion(s), which from our research, appears to be the best deal in the market, even better than applying directly from SingSaver at times.

There are frequent promotions like flash deals, reward upgrades, and lucky draws. Explore all the latest credit card deals!

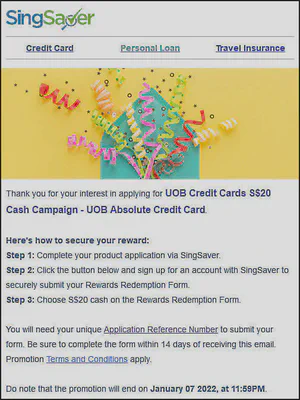

Tip: it can take some time for SingSaver rewards to be awarded. We highly recommend taking a screenshot of the promotion offer when you sign up to keep as a reference.

- If nothing appears after clicking the card application buttons, please disable your ad-blocker

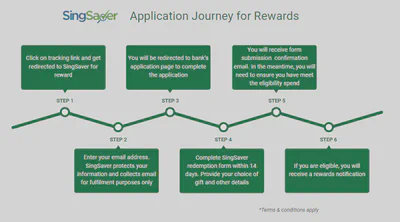

- Remember to note down your Application Reference Number (ARN) to submit claims for your SingSaver reward(s).

- The sign-up promotions change constantly. The sign-up pages contain the most up-to-date information.

Table of Contents

Card Comparison Page

If you are unsure which bank’s credit card to apply for, check out this comparison page by SingSaver: ‘Find The Best Credit Cards in Singapore 2025’

Recommended Card(s)

UOB Lady’s Card

UOB Lady’s Card is the only credit card that now gives you the freedom of choice to define your rewards; from Fashion, Dining, Beauty & Wellness and Family, to Transport, Entertainment and Travel. You also have the flexibility to change your categories every quarter, to suit your ever-changing lifestyle and interests.

Notes about preferred rewards category(ies)

- to check your enrolled category(ies), you can contact UOB either via chat or hotline.

- once you make any changes, it will effective on the next calendar quarter. E.g. Jan- Mar

Steamlined application process since 2022

It has been quite a while since I applied for a new credit card and I realised the process has been very much streamlined nowadays. I no longer need to upload a copy of my NRIC and payslip etc.

I just needed to login to SingPass MyInfo and UOB was able to retrieve my personal particulars, CPF contribution and other information required for the application.

My application process for an UOB Absolute Cashback Card was completed within 3 minutes.

I once applied for a card on 2 January 2022, and received it in my mailbox on 6 January 2022. I must say UOB is pretty efficient.

How do I redeem my SingSaver reward?

You may also wish to refer to the reward redemption FAQ on SingSaver.