Trust Bank Latest Referral Code: NV68VTDE and Usage Tips (by Standard Chartered and FairPrice Group)

Banking made transparent, easy and rewarding

Validity period: till 15 Jul 2025

Sign up for Trust with the referral code: NV68VTDE, and receive a scratch card in Trust App.

The scratch card will be available in your Trust app under the section “Rewards > Quests”. Scratch your card to win guaranteed cashback of S$8, S$18, S$28, S$188, S$288 OR S$1,888!

Also remember to check out any Welcome bonuses!

Terms and conditions apply.

Table of Contents

About Trust Bank

“Trust is designed and built to operate entirely on your mobile phone, using the latest and best technology. We focus on digitising as many of the traditional processes as possible, we don’t have any branches and we operate 24/7.”

Trust Bank, a digital bank backed by Standard Chartered and FairPrice Group, announced its launch in Singapore 1 September 2022.

What is a digital bank?

A digital bank (also known as neobank or virtual bank), offer services that one can expect from conventional banks, such as accepting deposits, loans, facilitating payments and loans, except that these will be performed online as digital banks do not have physical branches.

It is 60 per cent owned by Standard Chartered and 40 per cent by NTUC’s enterprise arm, obtained a full bank licence in December 2020. The bank’s shareholders have invested about US$400 million.

For a start, it is rolling out a range of products including a savings account, family personal accident insurance, and a “numberless” card that allows customers to choose their repayment date.

At launch, the digital bank entrant has ~200 full-time employees and intends to hire more as it expands its products and services.

Wildly successful launch in Singapore

Trust announced that it has reached 100,000 customers in just 13 days since its launch on 1 September 2022. Sign-ups were received from a diverse range of users aged 18 to over 90.

This can be attributed to their effective marketing strategy and solid credentials of the digital bank’s backers.

By February 2025, Trust has achieved the milestone of 1,00,000 customers and counting…

Core Products

Savings account

The Trust savings account offers attractive interest rates for deposits up to the account limit of S$800K.

No minimum balance required

There will be no minimum balance amount for the savings account.

Trust+

Level up to new banking experiences

Users who maintain a min. S$100K Average Daily Balance (ADB) for the month unlock Trust+ experiences from the following month.

These include:

- Specially curated experiences such as:

- 1-for-1 Weekday Buffet at Edge @ Pan Pacific Singapore

- up to 25% off at Far East Hospitality hotel bookings

- 1-For-1 Gold Class Movie Ticket at Golden Village

- Elegant in-app enhancements

- Priority in-app customer service

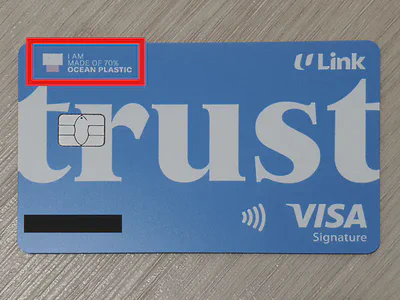

Numberless card

The bank’s “numberless” card will offer the dual functionality of a credit and debit card. Cardholders will not have to pay fees, such as an annual fee and foreign transaction fee, and will be able to choose their repayment date.

- Trust does not charge any foreign transaction/markup fees, not even the usual 1% Visa charge.

- If you enroll your card for Apple Pay and/or Google Pay, you can use them for in-store purchases.

Rewards

Get instant rewards such as coupons and stamps with your everyday spend on your everyday needs from participating merchants.

Security feature

The Trust app has a useful security feature which allows you to ‘Lock’ your card if it is misplaced. Simply:

- Log in to the Trust App

- On the card home screen, tap “View and Manage card”

- Select “Lock card”

Zero foreign transaction fees

With the Trust card, users enjoy zero foreign transaction fees, not even the usual 1% charge by Visa.

Family personal accident insurance

Trust Bank is offering a family personal accident plan which covers accidental death and permanent total disability due to an accident. This policy is underwritten and issued by Income.

The policy comes at a premium of S$0.50 per month and has no limit to the number of dependents covered. The policy will be available at no premiums for the first two months when a customer signs up for the bank’s credit card.

TrustInvest

TrustInvest is Trust’s first investment offering, allowing its customers to select from a range of investment solutions designed for the bank’s customers.

Investment offerings

As of February 2025, offerings include:

- Cash+: invest in a money market fund comprising Singapore government securities and unlock a yield usually higher than that of term deposits.

- Income+: invest in a fund comprising dividend paying stocks and corporate bonds to unlock a monthly income.

- Wealth+: invest in stocks and corporate bonds. Select from a lower, medium or higher risk fund.

FAQ

The complete FAQ can be found here. Listed below is a subset of some common questions.

General

Is my money safe with Trust?

Trust is regulated and supervised by the Monetary Authority of Singapore. The SGD deposits in your Savings Account by Trust are protected under the Deposit Insurance Scheme managed by the Singapore Deposit Insurance Corporation (SDIC) for up to SGD 75,000.

Can a foreigner open an account with Trust?

Foreigners residing in Singapore will need to provide the following:

- To apply for a credit card, you will need copy of your passport and income documents to be uploaded.

- To apply for a savings account, you will need copy of your passport details to be uploaded.

Savings Account related

Can I use an ATM to withdraw money?

Trust Bank will have its own ATMs, and there is currently one at Fairprice Vivocity. Customers can also access their accounts through Standard Chartered’s ATMs across Singapore.

What is the minimum age to apply for a savings account by Trust?

As of Feb 2025, the minimum age is 16.

How do I deposit money into my savings account?

There are 2 easy ways to deposit money into your savings account:

- Transfer from any bank via FAST or PayNow at no charge, or

- Set up standing instructions from other bank accounts

Can I open a joint-named savings account?

For now [Feb 2025], you can open a savings account in your name only.

Personal experience sharing and tips

Signing up

I was able to sign up using SingPass MyInfo within a few minutes on the launch date of 1 September 2022.

Claiming referral benefit and welcome bonuses

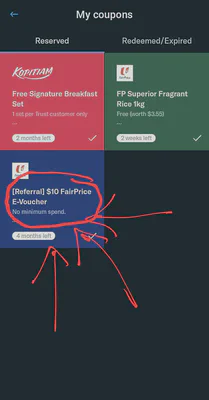

S$10 Fairprice E-voucher referral benefit

How and where to use the Fairprice E-vouchers?

The FairPrice E-Vouchers are valid at all FairPrice, FairPrice Finest, FairPrice Xtra, FairPrice Shop, Warehouse Club, Unity online and offline stores (except Changi Airport).

TIPS:

- I was able to use both the S$10 and S$25 vouchers in a single transaction. Just open both coupons for the cashier to scan.

- I was able to use the vouchers on my mum’s and my account in a single transaction.

- You can use the vouchers on the online FairPrice store by keying in voucher code manually in the payment screen.

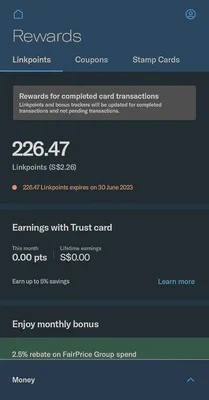

Link points integration

You can see your NTUC Linkpoints from the Trust Bank app.

Funding a Trust Savings Account

To find out your account number and transfer details to deposit, from the Trust app:

- Go to ‘Money’ section

- ‘Deposit’ tab

- Tap on the 3 dots beside ‘Send Money’

- Select ‘Account details’

from Standard Chartered Bank

My first deposit into my Trust Savings Account was from my savings account at Standard Chartered Bank.

I selected ‘Trust Bank Singapore Limited’ under the FAST transfer options and transferred $1 to test. The test deposit took around 5-10 minutes to reflect in the Trust app.

My second deposit of a larger amount was reflected instantaneously in the Trust app though.

from another Trust Savings Account

For my mother’s Trust Savings Account, I added her account as a payee of my account and transferred over some funds. The transfer was instantaneous.

Adding new payees takes time to reflect in Trust app

Whenever I add a new payee, out of caution, I will send a $1 test transfer first. I noticed that after adding the new payee and making the test transfer, the Trust app takes a few minutes before the payee list is updated in the app for a second transfer to be done.

Not a big issue but still a minor inconvenience. Hopefully Trust can improve on this soon.

Receiving the physical Trust debit card

I received my card in the mailbox around 5 days after applying. It arrived in a 100% paper packaging.

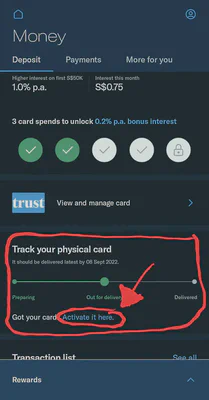

Activating the physical Trust debit card

You need to use the Trust app to activate the physical card.

Unable to set transaction limits on the Trust debit card

There is currently no way to place transaction limits on the Trust debit card. This worries me and I am reluctant to deposit more funds into my account for fear that it might be wiped out by fraudulent debit transactions.

How to use NTUC Fairprice e-Voucher from Trust Bank app at self checkout terminal?

Using the e-Vouchers at self checkout terminals is rather non-intuitive. Refer to this separate blog post for the detailed steps.

Activate Kill Switch to protect your account

In case of a suspected scam, Kill Switch is an in-app security feature that lets you immediately block access to your Trust App and Trust card(s).

Do note that you can only deactivate Kill Switch by calling the Trust Bank hotline, which can be found in the ‘Contact us’ section on Trust website.