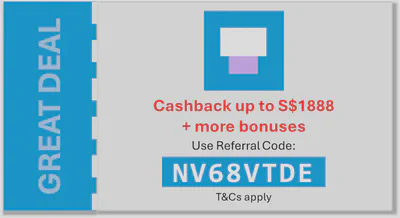

Trust Bank Latest Referral Code: NV68VTDE and Usage Tips (by Standard Chartered and FairPrice Group)

Banking made transparent, easy and rewarding

Sign up for Trust with the referral code: RF4AH5E0, and receive a scratch card in Trust App to receive cashback.

The scratch card will be available in your Trust app under the section “Rewards > Quests”.

Scratch your card to win guaranteed cashback of up to S$1,888!

Also remember to check out any Welcome bonuses!

Terms and conditions apply.

Table of Contents

About Trust Bank Singapore

“Trust is designed and built to operate entirely on your mobile phone, using the latest technology. We focus on digitising as many traditional processes as possible. We don’t have any branches and we operate 24/7.”

Trust Bank is a digital bank backed by Standard Chartered and FairPrice Group. It officially launched in Singapore on 1 September 2022.

What is a digital bank?

A digital bank (also known as a neobank or virtual bank) offers services typically provided by conventional banks — such as accepting deposits, facilitating payments, and offering loans — but operates fully online without physical branches.

Trust is 60% owned by Standard Chartered and 40% by NTUC Enterprise, and obtained a full digital bank licence from the Monetary Authority of Singapore in December 2020.

Trust offers a range of products including a savings account, personal insurance solutions, and numberless debit and credit cards managed entirely through its mobile app.

Strong adoption since launch

Since its launch, Trust has seen strong customer adoption in Singapore, supported by its digital-first proposition and the institutional backing of its shareholders.

Core Products

Savings account

The Trust savings account supports everyday banking needs, with interest rates and balance thresholds subject to Trust’s prevailing terms.

No minimum balance required

There is no minimum balance requirement for the Trust savings account.

Trust+

Level up your banking experience

Trust+ is a programme that offers enhanced experiences and privileges to eligible customers who meet qualifying balance requirements. Benefits may include lifestyle offers, in-app enhancements, and priority support, and are subject to availability and change.

Cards (Debit and Credit)

Trust offers separate debit and credit cards, both issued as numberless physical cards to reduce exposure of card details during transactions.

Trust cards feature:

- No annual fee

- No foreign transaction or FX markup fees charged by Trust, subject to card network rules.

- Contactless mobile wallet support (Apple Pay and Google Pay)

Rewards

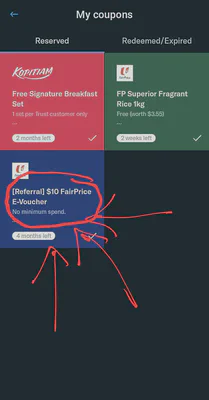

Rewards such as digital coupons and stamp cards may be available through participating merchant offers within the Trust App.

Security features

The Trust App allows customers to instantly lock their card if it is misplaced.

Insurance

Family personal accident insurance

Trust offers a family personal accident insurance plan covering accidental death and permanent total disability. Policies are underwritten and issued by Income Insurance.

Premiums, coverage limits, promotional offers, and eligibility criteria are subject to the insurer’s prevailing terms and may change over time.

TravelShiok travel insurance

TravelShiok is a travel insurance plan available exclusively to Trust customers. Coverage features and benefits vary by plan and are underwritten and issued by Income Insurance.

TrustInvest

TrustInvest is Trust’s investment platform, offering customers access to curated investment solutions within the Trust App.

Mutual Funds offering

TrustInvest offers a selection of funds designed for different risk profiles and investment objectives:

- Cash+ — money market fund focused on capital preservation and liquidity

- Income+ — portfolio with exposure to income-generating equities and bonds

- Wealth+ — multi-asset portfolios with varying risk levels

Stocks and ETFs

Launched in late November 2025, clients can trade in the US stock market and enjoy:

- Zero commission till 30 June 2026. After that, 0.05% commission per trade applies (min. 2.99 USD)

- Free fractional stock worth up to 500 USD. Simply make a trade of at least 1,000 USD

Promotional fees and rewards are time-limited and subject to change. Refer to the Trust App for current terms.

Key features:

- Fractional US stocks and ETFs with min. 10 USD

- Real-time stock prices

- No custody fee, platform fee, or settlement fee

FAQ

The complete FAQ can be found here.

General

Is my money safe with Trust?

Trust is regulated by the Monetary Authority of Singapore. SGD deposits in Trust savings accounts are insured under the SDIC Deposit Insurance Scheme, up to the prevailing statutory limit per depositor.

Can a foreigner open an account with Trust?

Foreign residents in Singapore may apply for Trust products subject to eligibility requirements and documentation, such as passport and income details where applicable.

Savings Account related

Can I use an ATM to withdraw money?

Trust customers can withdraw cash via Trust-operated ATMs and partner ATM networks in Singapore, subject to availability.

How do I deposit money into my savings account?

You can deposit funds via:

- FAST or PayNow transfers from other banks, or

- Standing instructions from another bank account

Can I open a joint-named savings account?

Currently, Trust supports single-name savings accounts only. Account features and availability may change over time.

Personal experience sharing and tips

Note: The following reflects personal experience at the time of writing. App features, interfaces, and processes may change.

Signing up

I was able to sign up using SingPass MyInfo within a few minutes on the launch date of 1 September 2022.

Claiming referral benefit and welcome bonuses

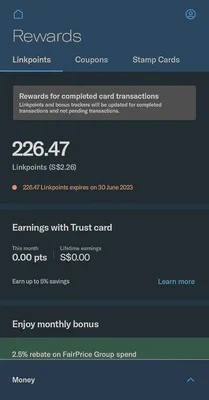

Link points integration

You can view your NTUC LinkPoints directly within the Trust App.

Security: Kill Switch

Kill Switch is an in-app security feature that allows you to immediately block access to your Trust App and Trust card(s) in the event of suspected fraud. Reactivation requires contacting Trust via its official support channels.