Syfe Managed Portfolios Invite Your Friends Programme

The trusted platform to grow your wealth

Promotion period: from now till Jun 2025, the referral benefits will be doubled. The values shown below have already been doubled.

Sign up with Syfe Managed Portfolios via the referral link or code: SRP6G4YN8 and receive up to 12 months of management fee waiver for your investments.

Tiers for management fee waivers:

- 6 months (for first deposit: $2,000)

- 8 months (for first deposit: $5,000)

- 10 months (for first deposit: $10,000)

- 12 months (for first deposit: $50,000 and above)

Other terms and conditions apply.

Important! First Lump-Sum Deposit = Initial lump-sum deposit made into account within the promotion’s stipulated qualifying period of 30 days upon the promo code application date. Subsequent deposits will not count towards the first deposit amount.

Syfe Managed Portfolios and Syfe Brokerage are two separate products on the Syfe platform.

New customers can enjoy referral benefits on both if they sign up for both within 30 days.

Table of Contents

What is Syfe?

Syfe is a digital investment platform that is building the next generation of financial solutions for individuals across Asia.

Launched in July 2019, Syfe’s mission is to transform the way people manage their money and make high quality financial services affordable and accessible to all.

Syfe has expanded to Hong Kong and Australia, and grown to cover a holistic range of investment solutions, from institutional-level fully managed portfolios and directly indexed REITs, to brokerage and cash management.

As of June 2025, with over 250,000 users in Singapore alone and now managing well over US$10 billion in assets across the region, Syfe is now one of the largest—if not the largest—digital wealth managers across APAC.

Major Developments

- Syfe has announced the successful close of its Series C funding round of US $80 million [5 Jun 2025]

- This latest round brings Syfe’s total funding to date to US $132 million and follows the recent strategic acquisition of Selfwealth, one of Australia’s most established and trusted online investment platforms.

MAS License

Syfe is licensed by the Monetary Authority of Singapore (“MAS”) under a Capital Markets Services (“CMS”) License (CMS License No: CMS100837) for retail fund management.

Awards

Syfe Cash Management

Cash+ Flexi

Earn projected returns on your SGD or USD with no lock-ins.

Cash+ Guaranteed

Launched on 22 August 2023, Cash+ Guaranteed lets users enjoy guaranteed returns on any investment amount, which sets it apart from the usual offering of personalised and custom portfolios.

Features:

- Funds invested into fixed deposits provided by banks in Singapore

- Enjoy competitive rates otherwise not available for retail investors

- Rates regularly-assessed from several bank providers. No need to keep switching banks to access higher rates

- Lock funds in 3, 6 or 12 months term

- Auto-reinvest at maturity - accelerate savings through power of compounding

WARNING: Cash+ Guaranteed is a managed investment portfolio, and should not be taken as a fixed deposit. Until the investment is locked in, the rate is subject to change. Investment capital and returns are guaranteed subject to underlying bank risk.

The bank account that used to manage the funds is insured by Singapore Deposit Insurance Corporation (SDIC) for up to S$75,000. However it’s important to note that this coverage isn’t applicable on an individual client basis.

Syfe Managed Portfolios

Syfe Managed Portfolios offers personalised and custom portfolios, enabling users to fulfil their long-term financial goals. The platform has no minimum investment amounts and maintains a low annual fee, starting at 0.35% per annum of the total amount invested.

Special mentions

Downside Protected S&P 500 Portfolio

Launched in September 2024, this portfolio helps investors capture the growth of the S&P 500 while minimising potential losses.

A webinar was conducted to share how the portfolio’s downside protection works, its re-optimisation feature to lock in gains, and how it plays a role in strategic asset diversification.

You can watch a replay of the webinar on Youtube:

SRS Investments

In Q4 2024, Syfe introduced Supplementary Retirement Scheme (SRS) investments, empowering clients to grow their retirement funds while enjoying significant tax relief.

Check out Syfe’s article: ‘Guide to Supplementary Retirement Scheme (SRS) in Singapore: What It Is and How to Maximise It’ to learn more.

Why Syfe for your SRS investments?

- All-in-one App: With SRS now on Syfe, you can manage all your investments—brokerage, cash management, managed portfolios, and now SRS—on one platform.

- Enhanced Tier Benefits: Your SRS investments count towards your Syfe tier level, unlocking lower fees and greater rewards as your investments grow.

FAQ

Are my investment funds secure if I invest through Syfe?

Trusted by over 100,000 investors in Singapore

Monies and assets are held in a custodian account through Saxo Capital Markets (“Saxo”), a MAS-regulated global broker. This means that my money and assets remain safe even if Syfe or Saxo stop operating.

Does Syfe use any leverage?

Syfe does not use any leverage or margin lending.

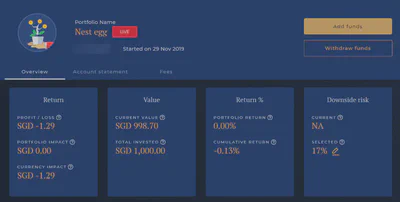

My onboarding experience

Back in 2019, my signing up was completed in just 5 minutes using SingPass MyInfo.

I started with a survey to determine the ideal investment profile for myself. After that, I deposited funds conveniently via PayNow and by the next day, my portfolio was created.

I started with $1000 and look forward for my “Nest egg” portfolio to grow.

Useful reads

What are the real fees you pay when buying funds or unit trusts?

An article by Syfe which advocates buying ETFs over unit trust or mutual funds and comparing their fees against banks, robo-advisors and self-serve platforms popular in Singapore.

It is quite lengthy but you can scroll down to the comparison tables if you are in a rush.