Sleek Referral Code: SLEEK10NEW (10% Off) or AFSGREF100 (S$100 Discount)

Making the lives of entrepreneurs, SMEs and investors easier

Looking for a Sleek referral or discount code?

We offer two discount codes for new-to-Sleek clients.

These codes are not applicable to existing clients, renewals, or add-on services. Discounts exclude government fees and are subject to Sleek’s prevailing terms and availability.

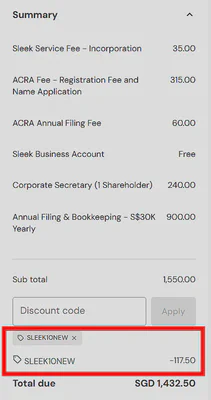

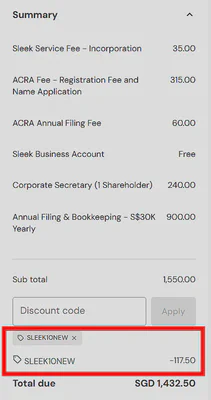

Option 1: 10% Percentage-Based Discount

You can receive 10% off eligible Sleek services with discount code: SLEEK10NEW

This percentage-based discount may result in higher savings for higher-value service packages.

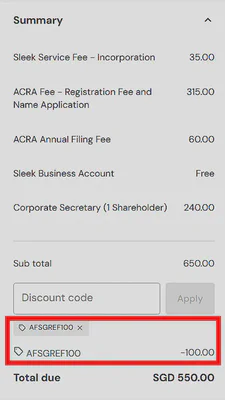

Option 2: Fixed-Value Discount

Alternatively, you may use discount code: AFSGREF100 to enjoy:

- S$100 off eligible Sleek services in Singapore

- HKD 500 off eligible Sleek services in Hong Kong

This fixed-value discount may offer better value for lower-priced or entry-level packages.

Which Sleek promo code should you use?

- If you are engaging higher-value services, the 10% discount (

SLEEK10NEW) may provide greater savings. - If you are purchasing a basic or starter package, the fixed S$100 / HKD 500 discount (

AFSGREF100) may be more cost-effective.

Only one code can be applied per order, and discounts cannot be stacked.

Illustrative examples of potential savings. Actual savings depend on services selected and Sleek’s prevailing fees.

Table of Contents

How to use a Sleek referral code at checkout

After selecting a service package that is eligible for a referral discount, proceed to the checkout page, click on “Add voucher code”, and apply the referral code.

About Sleek – Company overview

Making the lives of entrepreneurs, SMEs and investors easier. Effortless incorporation, registration, company secretary, and accounting — all on one platform.

Founded in 2017 in Singapore, Sleek provides corporate services across Singapore, Hong Kong, Australia, and the United Kingdom.

By 2022, Sleek had grown to over 340 employees (with more than 180 listed on LinkedIn) and has supported over 450,000 businesses globally to date, including through international acquisitions.

Major Payment Institution licence (MAS)

Sleek holds a Major Payment Institution licence issued by the Monetary Authority of Singapore, effective from 1 July 2022.

Awards and recognition

Geographic presence

Sleek began operations in Singapore and has since expanded its presence to multiple international markets, including:

- Singapore

- Hong Kong

- Australia

- United Kingdom

In addition to organic expansion, Sleek has grown its footprint through acquisitions. This includes the acquisition of Ltd Companies, a UK-based incorporation and compliance services provider that has supported more than 450,000 companies since 2005.

This multi-market presence allows Sleek to support founders and businesses with cross-border needs, while maintaining local compliance expertise in each jurisdiction.

Certifications and trust standards

B Corp certification

Sleek became a B Corp certified company in 2022. B Corp certification is awarded to companies that meet verified standards of social and environmental performance, accountability, and transparency.

SOC 2 certification

Sleek achieved SOC 2 certification in 2022, complementing its ISO 27001 certification.

SOC 2 (Systems and Organisation Controls 2) is a framework developed by the American Institute of Certified Public Accountants (AICPA) to assess an organisation’s controls relating to:

- Security

- Availability

- Processing integrity

- Confidentiality

- Privacy

This certification applies across the geographies in which Sleek operates.

ISO 27001

Sleek is certified under ISO/IEC 27001, an international standard for information security management systems (ISMS), which sets requirements for managing and protecting sensitive information.

Data Protection Trustmark (DPTM)

Sleek holds the Data Protection Trustmark (DPTM) certification, a voluntary certification issued by Singapore’s Infocomm Media Development Authority (IMDA).

The DPTM demonstrates that an organisation has implemented accountable data protection practices in accordance with Singapore’s Personal Data Protection Act (PDPA).

Investor backing and funding history

- Raised US$23M in Series B funding (Jun 2025), led by Ellerston Capital

- Series A extended to US$25M with investment from EDBI (Dec 2021)

- Earlier Series A funding of US$14M led by Jungle Ventures and White Star Capital (Nov 2021)

Services offered by Sleek

Sleek offers service bundles tailored for entrepreneurs, SMEs, venture capital firms, and sole proprietors.

Company incorporation services

- Singapore incorporation packages for locals start from $650 (indicative; subject to change)

- Singapore incorporation packages for foreigners start from $2,200 (indicative; subject to change)

Sleek Business Account

The Sleek Business Account is a virtual business account offered pursuant to Sleek’s Major Payment Institution licence:

- No minimum deposit, monthly fees, or minimum balance (subject to terms)

- Integrated bookkeeping features

- Local and international transfers at competitive FX rates

- Virtual corporate cards

- Multi-currency support

- Customer funds held in segregated accounts with DBS Bank Ltd

Accounting & CFO services

Sleek provides accounting and bookkeeping services with dedicated accountants and digital workflows.

CFO services are also available for growing businesses.

Corporate secretarial services

Sleek offers corporate secretarial services, including support for compliance, filings, and record maintenance.

Transferring your corporate secretary to Sleek can be completed online.

Digital signature (SleekSign)

SleekSign is Sleek’s electronic signature solution for documents recognised in Singapore.

Nominee Director Service

Following regulatory changes in 2024, nominee directors must be appointed through registered corporate service providers.

Learn more about Sleek’s Nominee Director Service.

What are top reasons to choose Sleek

- Trusted by over 450,000 businesses globally

- Transparent pricing and refund policies (excluding government fees)

- Certified Xero Platinum Partner

- ISO 27001 and DPTM certified

- Access to partner perks

Who Sleek may be suitable for

- First-time founders who want guided help with incorporation, compliance, and basic accounting

- Foreign entrepreneurs who need support with local requirements such as nominee directors or work passes

- SMEs looking for an integrated platform covering company secretary, accounting, and payment services

- Business owners who prefer a digital, self-service workflow with professional support

- Startups and growing companies that value convenience over fully bespoke arrangements

Who Sleek may not be suitable for

- Businesses with complex structures requiring customised legal advice

- Cost-sensitive founders comfortable managing compliance independently

- Larger enterprises with in-house finance and legal teams

Resources for business owners

Apart from its corporate services, Sleek provides a wide range of educational resources for entrepreneurs researching incorporation, compliance, and business operations.

Useful blog articles by Sleek

Some helpful guides published by Sleek include:

- How to Register a Business in Singapore

- Guide to permits and licensing in Singapore

- SSIC codes guide

- SSIC (Singapore Standard Industrial Classification) codes are used to classify a company’s business activities in Singapore.

Country guides

Sleek also provides incorporation and visa guides for foreign founders from various countries, including:

- Australia

- Bangladesh

- Hong Kong

- India

- Indonesia

- Malaysia

- New Zealand

- Philippines

- Sri Lanka

- Thailand

- Vietnam

Grants

Sleek publishes resources on government grants and funding schemes relevant to SMEs, including:

Partner Perks

The Partner Perks page unlocks up to SGD6,000 of savings for Sleek clients through partner offers across payments, cloud services, CRM, and insurance.

Frequently Asked Questions (FAQ)

What is the Sleek referral code currently available?

You can receive 10% off eligible Sleek services using voucher code SLEEK10NEW.

Why incorporate a company in Singapore or Hong Kong?

Singapore and Hong Kong are widely regarded as leading business hubs in Asia due to their transparent legal systems, business-friendly regulations, and international connectivity.

Singapore, in particular, is consistently ranked among the world’s top business environments by international indices such as the Economist Intelligence Unit (EIU) and IMD World Competitiveness rankings. It is known for:

- A competitive and transparent tax system

- Extensive double taxation treaty networks

- Strong regulatory and judicial frameworks

- Ease of doing business for both local and foreign founders

Hong Kong similarly offers:

- A low and simple tax regime

- Strategic access to Mainland China

- A mature financial and professional services ecosystem

These factors make both jurisdictions popular choices for entrepreneurs looking to establish regional or global operations.