Singlife Account Invite Code: h9zQM92N (Insurance Savings Plan Referral Promo)

Save, Spend, Earn & Be Insured

Table of Contents

About Singlife with Aviva

Singapore Life Pte. Ltd. (Singlife) is a direct life insurer licensed by the Monetary Authority of Singapore (MAS).

It announced a merger with Aviva in 2020.

Corporate Responsibility

Environment

Singlife with Aviva has appointed European sustainability data provider Matter to provide a comprehensive view of its sustainability performance. Matter’s leading ESG platform will help Singlife understand the sustainability impact and performance of its global investments.

Singlife’s Group Chief Investment Officer Kim Rosenkilde said, “We currently serve a significant proportion of Singapore’s population, so it is natural for us to act as more than an insurer or a financial services provider. We must be a responsible steward of the funds we manage. Gaining more insights into the sustainability profile of our investments is a key part of that stewardship”.

See full press release on 12 apr 2022

UN Sustainability Signatory

In July 2022, Singlife with Aviva announced that it has become an official signatory of the United Nations’ Principles for Sustainable Insurance (PSI), a global sustainability framework and initiative of the United Nations’ Environment Programme Finance Initiative (UNEP FI).

Singlife is said to be the first local entity to be recognised as a signatory

Product information

Singlife Account

The Singlife Account is an insurance savings plan. It is neither a bank savings account nor fixed deposit.

Protected by SDIC

All Singlife policies, including the Singlife Account are covered under the Policy Owners’ Protection (PPF) Scheme administered by Singapore Deposit Insurance Corporation (SDIC). The PPF Scheme protects policy owners in the event a life insurer which is a PPF Scheme member fails.

Insurance Benefits

You get life insurance coverage of up to 105% of your account value and retrenchment benefits.

Daily calculated returns

Returns are calculated daily and credited monthly.

Non-guaranteed returns

The returns of the plan are non-guaranteed.

Lock-ins and withdrawal fees

Singlife offers flexibility to its customers with no lock-ins or withdrawal fees. I have personally withdrawn some funds via FAST before, and the experience was fuss free and quick.

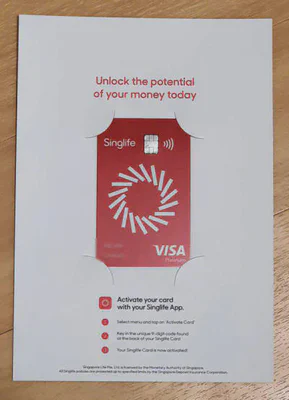

Singlife debit card

The Singlife debit card is linked to your funds in the Singlife account.

It comes with the following daily limit presets:

- S$5,000.00 for local/oversea transactions; or

- 15 transactions by Singlife Card; or

- S$20,000.00 for withdrawals by FAST.

I wrote in to inquire about how to change these values as they are greyed out in the Singlife app. Unfortunately, I was informed that these values cannot be changed by the end user.

Even though there is an option to lock the card via the Singlife app in the event that the card is lost, I still don’t feel safe carrying around a debit card that allows such large transactions.

Singlife Sure Invest (Investment-Linked Policy with No Lock-in)

Investing for busy people | Investing made simpler

Singlife Sure Invest (formerly Singlife Grow) is an investment-linked life insurance plan that provides a flexible combination of investment and protection, including death and terminal illness benefits.

Through Singlife Sure Invest, you can invest in portfolios that are managed by world-class investment experts abrdn (formerly known as Aberdeen Standard Investments).

This short video on Youtube gives a very good overview on Singlife Sure Invest:

abrdn has released an assessment of market performance in Q1 2022, giving a detailed look at what incidents are impacting Singlife Sure Invest portfolios.

An Investment-Linked Policy (ILP) is a life insurance policy which provides a combination of investment and protection.

Like other ILPs, Singlife Sure Invest does not provide guaranteed returns. Investment returns are based on your portfolio performance and the value of the units and the income accruing to the units, if any, may fall or rise.

As such, you need to select portfolios that meet your investment objectives and risk profile.

My Singlife Experience

Signing up

You will need to download and install the Singlife app to create an account with your mobile number. You can either enter your details manually or via SingPass MyInfo.

The process takes around 10mins. You also need to verify your email.

Depositing money into Singlife Account

After the Singlife account was created, the app provided me with a DBS account number to fund my account.

I transferred funds to it via FAST and it was updated within the Singlife app within a couple of minutes.

Privileges and Deals

Within the app, users can also find special deals exclusive to Singlife customers.