Saxo Markets Refer A Friend Promotion

Online Trading, Forex, CFDs, Stocks & Investing

Current promotion validity period: 1 Jul to 30 Sep 2025

Receive SGD 28 Commission Credits and up to SGD 250 Cash when you sign up with Saxo Markets via the referral link.

Commission Credits:

- Simply fund your account with at least EUR 10 (or the SGD equivalent) to receive.

Cash:

- Fund SGD 3,000, place at least 3 trades and receive SGD 100 cash reward.

- Fund SGD 100,000, place at least 3 trades and receive SGD 250 cash reward.

Please note that you will need to fund your account and place the 3 trades within 30 days of your account approval to qualify.

Other terms and conditions apply.

Table of Contents

About Saxo Markets

Saxo Markets is a subsidiary of Saxo Bank, a fully licensed and regulated Danish bank with an online trading platform that empowers you to invest across global financial markets.

Saxo Bank A/S has been awarded with an A- credit rating from S&P and appointed a Systemically Important Financial Institution, and the Saxo Group is trusted by over 1.2 million clients globally with more than USD 100 billion in client assets.

Saxo Markets has operated in Singapore since 2006 and serves as the APAC headquarters.

Social media

Telegram

In October 2022, Saxo Markets launched a Telegram group named SaxoSingapore, where traders and investors can connect, share and inspire each other.

Reasons to use Saxo

Access to 3,500+ mutual funds

Users can invest in 3,500+ mutual funds from the world’s top money managers, with zero commissions and zero custody fees or platform fees and only management fees, through Saxo platforms.

Access to China A-Shares Market

It is one of the few brokers in Singapore that allows access you to trade and invest in stocks and ETFs listed in Hong Kong, and shares listed in the Shanghai and Shenzhen Stock Exchanges.

What are A-Shares?

A-Shares, also known as domestic shares are shares that are denominated in Renminbi and traded in the Shanghai and Shenzhen stock exchanges, as well as the National Equities Exchange and Quotations

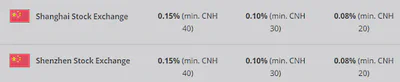

China A-Shares commission rates for Classic, Platinum and VIP membership tiers:

You can also view a fees comparison with other local brokerages here.

Earn interest on account balances

All clients on Platinum or VIP account tiers will earn interest on their account balance above SGD 5,000 (or equivalent) at a rate varying with the account balance.

The more you deposit, the higher rate you will earn.

Clients will earn the best rate on account balances above SGD 100,000 (or equivalent), with no cap on how much they can deposit. With no lock-in, funds will remain available to withdraw or invest, while earning interest.

Extended hours trading

Clients have the flexibility to trade certain US stocks, ETFs and single stock CFDs during pre-market (7:00 am - 9:30 am ET) and after-hours (4:00 pm - 5:00 pm ET).

Regulated

Saxo Capital Markets Pte Ltd (‘Saxo Markets’) is a company authorised and regulated by the Monetary Authority of Singapore (MAS) [Co. Reg. No.: 200601141M]

Securities Lending | Potentially earn extra revenue

Once Securities Lending is activated, all eligible securities in an account will become available for lending.

Depending on market demand, securities from an account can be lent out to third parties. In exchange, clients can receive a monthly payment for revenue generated by the loan.

Key features:

- set up is fully automated, and Saxo takes care of the lending process

- clients can opt out again at any time.

- clients can always sell the loaned securities at any point.

- custody fee is waived (as of 1 December 2023).

No platform, custody and withdrawal fees

Saxo offers zero platform and withdrawal fees. Terms and conditions apply for zero custody fees.

0.25% currency conversion fee

The 0.25% currency conversion fee charged is one of the market’s absolute lowest rates!

Low minimum commissions for global markets

Examples (as of March 2024):

- US stocks: USD 1

- UK stocks: GBP 3

- HK stocks: HKD 15

SaxoWealthCare | Personalised Wealth Management

“SaxoWealthCare gives you personalised wealth management at a fraction of the price of traditional banks and wealth managers, competitive with robo-advisors.”

Apart from the brokerage services, Saxo also offers SaxoWealthCare.

It is a digital wealth manager that offers:

- Personalised portfolio: Invest in what fits your values and financial goals

- Automated rebalancing: Keep your goals on track and your risks under control, automatically

- Low cost: Competitive management fee, only 0.45% until 31 July 2022.

- Human support: Always get the help you need from an expert support team

Exchange Traded Funds (ETFs) are the investment instruments used with the deposited funds. A curated list of stocks and bonds ETFs are mixed and matched to suit the investment plan and risk profile for each client’s personalized portfolio.

What stands out for me is that the portfolios:

- have a higher ESG (environmental, social and governance) rating than the stock market average.

- have No lock-in period

- clients can withdraw funds or update goals anytime, for free.

- are monitored, reviewed and even rebalanced daily if needed.

While there is no minimum investment period, there is a minimum investment amount of SGD 3,000.

For existing Saxo clients, no new account is required to start an investment plan in SaxoWealthCare. Simply log in to the platform and click ‘Portfolio’ to get started.

Usage notes

Fund transfer through eGIRO

Clients can transfer funds immediately into their Saxo account in a single step, by connecting their local Singapore SGD bank account via Direct Debit Authorisation (eGIRO).

For more information and detailed steps, visit: ’eDDA: the complete guide’

Birthday Benefits

Staying safe from scammers

Be wary of scams that can take place in the form of online stock recommendations from unofficial sources or informal chat groups.

Scammers might impersonate real people from genuine financial services firms to tempt you into investing in any recommended stocks/investment products. Some scammers might use spoofed or unofficial social media accounts to spread and disseminate false information.

You can protect yourself and others by observing the following:

- Change your privacy setting in your messaging apps to prevent others from adding you to random investment chat groups.

- Be wary of stock tips/ recommendations from unofficial sources (e.g. Social Media platforms/Messaging App)

- Do your research before investing in any investment product

- Check the credentials of the supposed company or representatives using sources such as MAS Financial Institutions Directory, Register of representatives and Investor Alert List.