RealVantage Referral Promo

Your vantage point for smart real estate investing.

Validity period: till 31 Oct 2024

Receive an extra 0.25% p.a. on your investment amount, when you sign up with RealVantage via the referral link, and invest in the same opportunities as me. Terms and conditions apply.

Projects eligible for referral bonus that I invested in:

- ACP Senior Loan Portfolio - SGD [Sep 2024]

Table of Contents

About RealVantage

Start building your global real estate portfolio

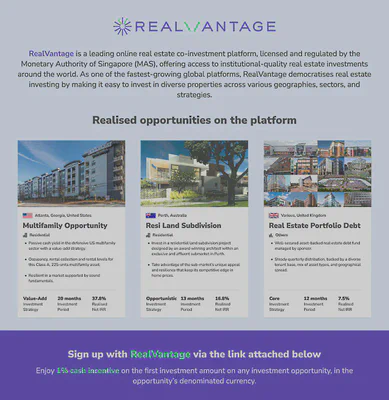

Founded in 2019, RealVantage is a licensed and regulated co-investment platform that provides investors access to institutional quality real estate investments across different geographies, property sectors and investment strategies.

Being a real estate specialist, RealVantage offers high quality real estate investments that are vetted by industry veterans with experience from real estate asset management and development companies.

To enable investors to build a meaningful and diversified portfolio, RealVantage originates opportunities across different property types, including residential, multi-family, hospitality, office, retail, medical, logistics and industrial.

Investors can also choose from lower-risk real estate secured debt opportunities to higher-return development opportunities so as to create a portfolio with recurring income and capital gains across multiple property sectors and geographies.

Understanding Real Estate Fractional Investment with RealVantage:

Visit the RealVantage Youtube channel for more informative videos and webinars.

5th Anniversary in 2024

RealVantage achieved its five anniversary milestone in 2024. Check out the video of their journey so far.

RealVantage managed to grow its investor base by over 50% compared to the previous year; and tripled the number of new family offices and corporations joining the platform.

It also deepened collaborations with leading sponsors including CapitaLand Investment, Investcorp, and ESR; securing top-tier investment opportunities for its investors.

In the media

Straits Times

How does RealVantage make Real Estate Investment available to the masses?

RealVantage was featured in The Straits Times June 10, 2024 release’s Business Section under its Company Watch column. Read: ‘RealVantage breaks down walls in real estate investing for the masses’.

The Peak Singapore

In February 2025, Co-founder & CEO, Keith Ong, was featured in The Peak Singapore. During the exclusive interview, Keith shared about the driving force behind RealVantage.

Building RealVantage from the ground up, his only mission is to make institutional-grade real estate opportunities accessible to individual investors.

Read the full article here.

AUM

According to an article published in The Straits Times on June 10, 2024, RealVantage has around $400 million worth of assets under management.

Footprint

The company, whose Singapore office is at Aperia Mall in Kallang, is planning to open outlets in Malaysia and Hong Kong in the near future, and will increase its staffing of 25 to 35.

RealVantage has funded deals for properties in Singapore, the United States, Britain, Australia and Hong Kong. That will soon extend to cover East Asia, specifically in key cities such as Tokyo, Osaka and Seoul.

Licensed and Regulated by Monetary Authority of Singapore (MAS)

On Jan 12, 2022, RealVantage obtained a Capital Markets Services (CMS) licence from the Monetary Authority of Singapore (MAS). The licence allows the company to provide Singapore-based retail investors with access to private equity real estate investments globally, such as UK, US, Australia, Hong Kong, Japan and Singapore.

Experience sharing

SingPass MyInfo sign up

Spare yourself from filling up long forms. RealVantage supports signing up via SingPass MyInfo.

Note that after signing up, RealVantage still needs to perform Know-Your-Custoemr (KYC) and Anti-Money Laundering (AML) checks. Thus, it might take a few business days before your account opening is complete.

Ease of funding account

RealVantage allows individual investors to link a bank account and use direct debit to fund their account almost instantly. As of April 2024, the supported banks are:

- DBS

- Maybank

- OCBC

- UOB

For corporate investors, more banks are supported.

What attracts me to RealVantage

Every deal is vetted by industry experts

- All deals are assessed by experienced professionals, with an investment committee that comprises industry veterans

- Less than 10% of the deals analysed clear the bar to be offered on the platform to investors

Global opportunities

RealVantage investors have participated in real estate deals across 20+ cities and 5 major markets across US, UK, AU, SG, and HK SAR.

Low minimum investment amount

If you search around the web, you might find articles stating that the minimum investment amount with RealVantage is $25000-$50000. The information in these articles are outdated.

My first investment with RealVantage in April 2024 was for $5000 Australian dollars.

Transparency

When signing up, RealVantage is transparent about risks with their risk disclosure statement on “Small offers exempted securities”.

Key points include:

- You should NOT invest in the securities or securities-based derivatives contracts offered unless you fully understand the risks and are prepared to take the risks.

- There is a high risk that you may lose all your money on such investments. Investments available through this platform/facility may include the shares or debt securities of early-stage companies or companies without a proven track record.

- It may be difficult or even impossible for you to cash in on or exit such investments. Such investments are subject to resale restrictions set out in section 272A(8) of the SFA, and there may not be a secondary market for them.

Zero capital loss for investors as of 15 April 2024

Since the platform’s launch, 65 deals have been funded, with 24 deals realised. To date, investors have not suffered any capital loss.

Disclaimer

All investments involve risks and are not suitable for every investor.

There is always the potential of losing money. Investors should consider their investment objectives and risks carefully before investing.

Any reward(s) which are received via any promotion campaign does not constitute as an invitation, inducement, recommendation, suggestion, or solicitation to investing.