Instarem Referral Code: gQfEDQ

Fast, Seamless, Low Cost Overseas Money Transfers | Travel and save with amaze card

Sign up with Instarem via the referral code: gQfEDQ or referral link to receive bonus 200 InstaPoints (worth S$2.50).

Table of Contents

About Instarem

Simplifying Payments Globally – It’s in Our DNA

Instarem is the trading name of NIUM Pte Ltd, a Singapore-headquartered Fintech company offering digital cross-border money transfers to individuals and businesses.

NIUM Pte Ltd is regulated by the Monetary Authority of Singapore as a Major Payment Institution under License No. PS20200276.

What are InstaPoints (IPs) and what can I use them for?

InstaPoints are Instarem’s rewards points that can be:

- used to offset against the fees of remittance transactions

- converted into KrisFlyer miles

redeemed as cashback(feature ceased from 10 March 2025)

Service Portfolio: Remittance

Why should I use Instarem for remittance?

- Regulated by the Monetary Authority of Singapore (MAS). I wouldn’t advise to use any service not regulated by MAS.

- Better FX rates than banks.

- Instarem offers zero-margin* FX rates. According to them, many banks and Money Transfer Providers add a mark-up to the FX rates they offer to their customers for sending money abroad. Besides, there are other hidden charges which makes for an inefficient, international money transfer experience.

- You can sign up conveniently using SingPass MyInfo

- Instant transfer to Visa debit cards

- Transparency, low remittance fee and zero hidden charges.

- Send money to Malaysia instantly

- send money to your loved ones in real time and faster than banks!

- in December 2023, Instarem started supporting DuitNow; users only need to know their recipient’s DuitNow ID like their mobile or passport number to send money.

- Large number of countries supported

- Asia: Bangladesh, China, Hong Kong, India, Indonesia, Japan, Malaysia, Nepal, Philippines, Singapore, South Korea, Sri Lanka, Thailand, Vietnam

- Europe: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Monaco, Netherlands, Norway, Poland, Portugal, Romania, San Marino, Slovakia, Slovenia, Spain, Sweden, United Kingdom

- North America: USA, Canada, Mexico

- South America: Argentina, Chile, Colombia, Peru

- Oceania: Australia

*applicable only for certain currencies and certain trading hours

Personal experience

My impressions of Instarem remittance:

- Signing in is convenient via Facebook and Google social accounts.

- Transfer of funds to Instarem can be via PayNow.

- I have sent monies to Malaysia, and recipients typically receive the funds really fast (as short as 1 minute).

- Supports sending monies to foreign businesses.

- I once purchased some goods from Australia and needed to pay the foreign business >$1000AUD. I was able to do this via Instarem rather than through a bank and thus saved some expensive TT fees.

- Not every remittance service supports paying to businesses so I view this as a big plus point for Instarem.

Service Portfolio: amaze card

“This smart travel card is a must-have for anyone who loves to travel.”

The ‘amaze card’ is both a virtual and physical card that can combine up to 5 Mastercard debit/credit cards. This eliminates the need to carry multiple cards.

Each time a transaction is charged to the amaze Card:

- Instarem converts any foreign currency (FCY) amounts into Singapore dollars based on its own internal exchange rate

- the Singapore dollar amount is then charged to the linked credit/debit card

Users settle the transactions made with the amaze card as per normal (directly with the underlying card issuer).

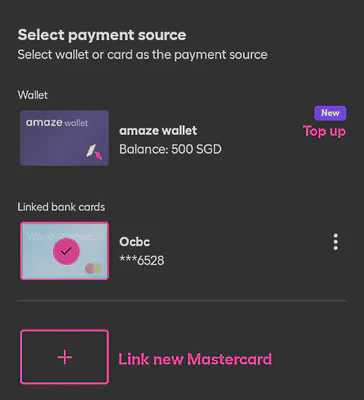

Within the Instarem app, users can choose to fund transactions made with the ‘amaze card’ via:

- any of the Mastercard debit/credit cards that are bound

- the ‘amaze wallet’

What is the ‘amaze wallet’?

As mentioned previously, the ‘amaze card’ only supports binding Mastercard cards. This results in Visa card holders being unable to enjoy other benefits of the ‘amaze card’ like good overseas FX rates and deals with partner merchants.

The ‘amaze wallet’ helps to overcome this shortcoming. It is a digital wallet that allows fund top-ups from Visa cards.

As of October 2022, there is a cap of S$3000 that the ‘amaze wallet’ can hold.

More reasons you should get an amaze card for yourself

- FREE card with no annual or processing fees:

- Users are not charged for applying an ‘amaze card’. There are also no annual or processing fees!

- Earn Instapoints:

- Earn 0.5 InstaPoint per 1 SGD spent, both locally and overseas, with amaze card linked to your amaze wallet balance.

- Deals with partner merchants:

- Check out special deals you can enjoy when using the ‘amaze card’.

- Mastercard’s World tier benefits:

- Enjoy all the benefits of Mastercard’s World tier with Instarem’s ‘amaze card’. You’ll get zero liability protection, ID theft protection, global emergency services, and more!

- Enjoy good FX rates and no overseas transaction fees:

- When you use the ‘amaze card’ overseas, the transaction is converted back to SGD at favourable rates offered by Instarem. Thus there are no overseas transaction fees involved.

- Note that Instarem’s rates are not the spot rate found on Google.

- Overseas ATM withdrawal support:

- withdraw up to SGD 1,000 (foreign currency equivalent) daily while overseas

- supports ATMs with Mastercard®, Maestro® or Cirrus® logo.

- note that some ATM operators may charge additional withdrawal fees or impose a minimum withdrawal amount.

- GPay (Google Pay) support:

- You can use the ‘amaze card’ on Google Pay and enjoy greater convenience by paying with your Android phone. This also allows you to stack the cashback with any Google Pay rewards.

- Lock in the best rates to convert anytime:

- hold, convert and spend in 10 currencies: SGD, AUD, CAD, CHF, EUR, GBP, JPY, NZD, THB, and USD.

Personal experience

I was initially reluctant to tie my credit cards from other banks into the ‘amaze card’ because I was worried that the Merchant Category Codes (MCC) for transactions would be altered, and render the transactions ineligible for points and cashback from the card issuing bank.

Upon checking with Instarem, I learned that the MCC for transactions are passed through to the underlying card so my worry was unfounded.

Caution on amaze card related fees

- Payments that fall under MCC 6540 (e.g. E-wallet top ups) and MCC 4111 (EZ-Link wallet top-ups and TransitLink General Ticketing Machines only) will incur a 1% MCC fee (min. 0.50 SGD).

- When amaze is linked to a card, a 1% fee (min. 0.50 SGD) will be applied on all monthly domestic spending in excess of 1,000 SGD.

For more details, check out the ‘amaze card related fees’ article by Instarem.

Caution when switching the amaze card payment source

As shared earlier, the amaze card allows you to bind multiple Mastercards to it, and select which card to use as the payment source when making purchases.

One liner summary of the issue: the amaze card charges the payment source at the point of time the transaction is posted, and not at the point of time where the transaction is first made.

Details: I had wanted to use my ICBC Mastercard for a recent purchase on Amazon.sg, and had selected the card as the payment source when I checked out the purchase. However, Amazon.com only charged my card the next day, but by then, I had already switched the payment source to a different card. This resulted in me missing out on the cashback benefits my ICBC Mastercard was offering.

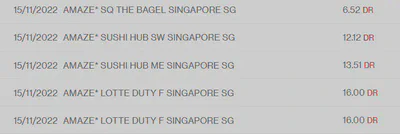

Overseas transactions

I observed that for my trip to Australia in November 2022, the charges posted to my credit card in SGD were about 2% higher than the rates used by Mastercard.

Example:

- Hotel booking in foreign currency: USD 1156.42

- Charge to my credit card in Singapore currency: SGD 1,658.57

Comparison against rates on

- Google: USD 1156.42 = SGD 1,621.63

- calculations: (1658.57 - 1621.63) / 1621.63 x 100% = 2.27%

- Mastercard Currency Convertor Calculator: USD 1156.42 = SGD 1,625.11

- calculations: (1658.57 - 1625.11) / 1625.11 x 100% = 2.05%

Taking into consideration that I get to earn Instapoints, and that I do not have to pay the bank’s overseas transaction fees, this is a still acceptable FX spread.

PSA: Beware of illegal activities

Keep your account safe. Never facilitate fraud and money laundering by being a money mule.

- Stay away from deals offering to purchase your account.

- Never let someone else access or watch you access your account.

- Don’t make payments on behalf of another person.

- Never share login details of your account with someone else.