Citibank Credit Cards Sign-up Promotion

There’s a Citi Card for your every need. Be rewarded as you spend.

We are tying up with SingSaver to present Citibank credit card promotion(s), which from our research, appears to be the best deal in the market, even better than applying directly from SingSaver at times.

There are frequent promotions like flash deals, reward upgrades, and lucky draws. Explore all the latest deals!

Tip: it can take some time for SingSaver rewards to be awarded. We highly recommend taking a screenshot of the promotion offer when you sign up to keep as a reference.

- If nothing appears after clicking the card application buttons, please disable your ad-blocker

- Remember to note down your Application Reference Number (ARN) to submit claims for your SingSaver reward(s).

- The sign-up promotions change constantly. The sign-up pages contain the most up-to-date information.

Table of Contents

Citibank credit cards landing page

Visit SingSaver’s Citibank credit card landing page which clearly lists the sign-up offers available for eligible credit card.

Card Comparison Page

If you are unsure which bank’s credit card to apply for, check out this comparison page by SingSaver: ‘Find The Best Credit Cards in Singapore 2025’

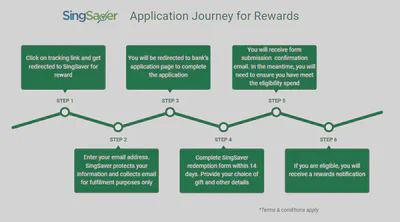

How do I redeem my SingSaver reward?

You may also wish to refer to the reward redemption FAQ on SingSaver.

How do I upgrade my SingSaver reward?

Sometimes, SingSaver will run special campaigns to allow new sign-ups to upgrade their rewards by paying a sum of money. The journey to upgrade an award is as follows:

- Submit your email to start the application process.

- Complete your application on the bank’s platform.

- Fill up the redemption form (Gift upgrade options will be available at gift selection field)

- Complete promo requirements

- SingSaver will send email confirmation once ready for gift collection.

- Make the payment at the allocated redemption center (ShortQ or Challenger)