AutoWealth Friends & Family Referral Programme

So you can have more wealth & time for things that matter

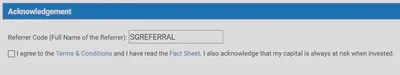

Get $20 top-up in your investment account with AutoWealth when you sign up with the referral code: SGREFERRAL

IMPORTANT!

Note that you have to fund your account within 2 weeks to be eligible for the referral benefit.

Table of Contents

About AutoWealth

“Fully automated investing at 1/4 fees. So you can have more wealth & time for things that matter.”

AutoWealth is a regional robo-advisor, based in Singapore, that automates investing, allowing you to skip costly middlemen & get good returns at a low fee.

Why I chose AutoWealth out of the various Robo Advisors available in the market?

1. Licensed by Monetary Authority of Singapore

It is licensed by MAS with a Financial Advisor Licence: FA100064-1

2. Portfolio company of NUS Enterprise

It is a portfolio company of NUS Enterprise.

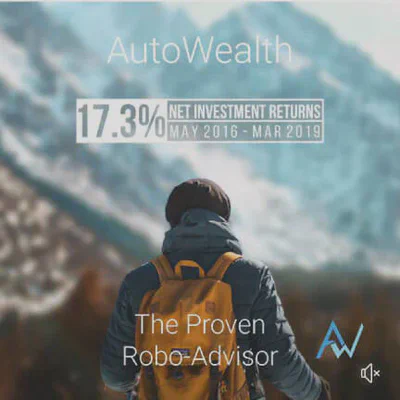

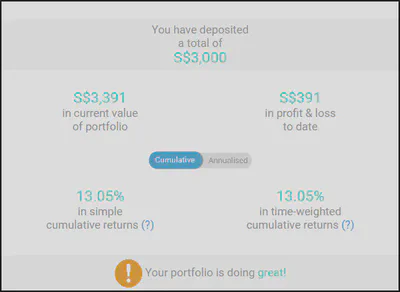

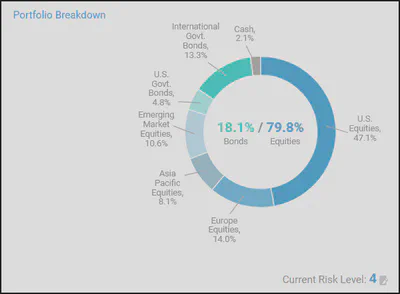

3. Good performance and diversification

From the marketing material I saw:

“Despite the recent market correction, AutoWealth still generated 17.3% in returns (net of fees & currency impact) between May 2016 and March 2019 on a 60% stocks / 40% govt. bonds portfolio.”

“That puts AutoWealth’s performance way ahead of the average (5.1%) & median (5.0%) Global Balanced Mutual Funds available in Singapore.”

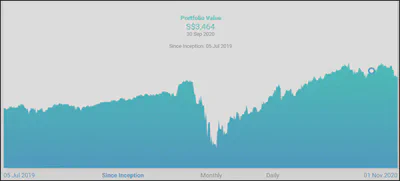

4. Beautiful user interface

The user interface dashboard presents key account information in an easily readable format. You can also choose to login with SingPass.

5. Custodian account at Saxo Capital under my own name

In contrast with many other robo-advisors, AutoWealth have always insisted on setting up personal, segregated custody account, with our partnering independent custodian Saxo Capital Markets, in your own legal name to hold your assets.

This clear ownership structure offers the highest possible safeguard for your assets and monies against an unforeseen event of insolvency or cessation of business.

Milestones

Launch of AutoWealth Plus+ [Sep 2022]

AutoWealth Plus+ is an innovative thematic offering that features:

- Only an annual performance fee of 8% on profits in each calendar year. If there are no profits, AutoWealth will charge zero fees.

- 100% equity-based portfolios with strong historical performance.

- Investment in long-term megatrends with high growth potential

The AutoWealth Plus+ product was first soft launched in January 2021, and more than a year later, it has now been fully launched and available on the platform for all eligible clients.

If you are interested in the webinar of the AutoWealth Plus+ soft launch on 18 January 2021, you can find it on the official AutoWealth YouTube channel.

Android and iOS app launched! [Oct 2021]

The AutoWealth platform used to be available only via web browser. Things changed on 4th Oct 2021 when the launch of the AutoWealth App was announced. The app is now available on IOS App Store and Android Google Play Store!

Implemented as of 4th Oct 2021:

- Biometric Authentication – an easy and secure way to provide authorised access and verification to any request pertaining to your portfolio.

- Load Time Optimisation - faster access to your portfolio performance in just a few seconds!

- New Funding Instruction Page – a more seamless way to submit and keep track of your adhoc/recurring funding instruction.

Upcoming features:

- Rewards Tab

- AutoWealth Plus+ Full Launch

Onboarding Process

The whole process takes quite a few days.

- I first submitted particulars to create an account online.

- Next, I had to sign some forms online and perform ID verification.

- After verification, an account was created for me to login and I was contact by my Wealth Manager who was very helpful and responsive to my questions.

- After I funded the account, a custody account was created at Saxo Capital Markets. I am able to login to a view-only mode of the portfolio of my holdings under AutoWealth.

Experience Sharing

Viewing my custody account at Saxo Capital Markets

I like that there is a custody account under Saxo Capital Markets and I can login anytime to view my holdings.

To view your custody account at Saxo Capital Markets, you have to login via this URL: www.saxotrader.com/monitor and not www.saxotrader.com

I wasn’t aware of this initially and was wondering why my login kept failing even though I entered the right login information and even tried resetting the password.

Viewing referral rewards

To view your referral rewards, you have to login to www.saxotrader.com/monitor and select 'Deposits and Transfer' -> 'Historic Cash Transactions'.

Platform stability concerns

In March 2022, it was in the news that robo-advisor ‘Smartly’ was winding up. It got me worried about my investment in AutoWealth.

My worries were unfounded as shortly after, I received an email reassuring me how AutoWealth protects my holdings through a Saxo Capital Markets custodian account.