AutoWealth Referral Code Singapore: Get $20 Bonus + Fees Review

To Make Good Investing Accessible, Affordable & Approachable

Use the AutoWealth referral code: 197EW0-referral to receive a $20 bonus credit (subject to prevailing terms).

To qualify:

- Enter the referral code during registration

- Fund your account within the eligibility window (typically within 2 weeks of approval)

Table of Contents

About AutoWealth

“Automated investing with transparent fees, so you can focus on what matters.”

AutoWealth is a Singapore-based robo-advisor licensed by the Monetary Authority of Singapore (MAS). It offers automated, globally diversified portfolios for Cash, SRS and CPF investing.

AutoWealth is authorised to provide advisory services under the CPF Investment Scheme (CPFIS) and has launched digital portfolios for CPF members.

The platform focuses on disciplined portfolio construction, transparent pricing and segregated custody.

Why I Chose AutoWealth Among the Robo-Advisors in Singapore

1. Licensed by the Monetary Authority of Singapore

AutoWealth holds a Financial Adviser Licence (FA100064-1) issued by MAS and operates under Singapore regulatory oversight.

2. Supports CPF Investing (CPFIS)

AutoWealth offers digital investment portfolios under the CPF Investment Scheme (CPFIS). This allows eligible CPF members to invest approved CPF savings through a managed portfolio structure.

CPF investing is subject to CPF Board rules and eligibility requirements.

3. Segregated Custody with Saxo Capital Markets

Client assets are held in individual segregated custody accounts with Saxo Capital Markets Singapore under your legal name.

This ensures clear ownership and ring-fences assets in the event of business cessation.

4. Diversified Investment Approach

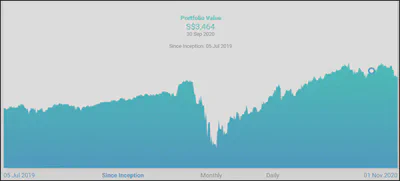

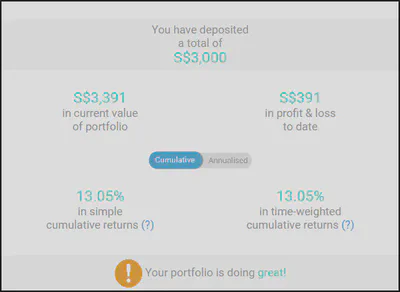

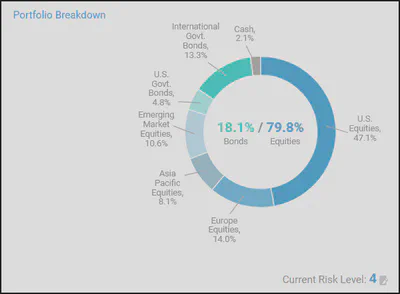

Portfolios are globally diversified and automatically rebalanced.

As with all investments:

- Portfolio values fluctuate

- Returns are not guaranteed

- Past performance is not indicative of future results

5. Clean and Intuitive User Interface

The dashboard provides:

- Portfolio allocation overview

- Performance tracking

- Sector exposure

- Holdings transparency

SingPass login is supported.

AutoWealth Portfolio Types

Always refer to the official website for the latest fees and eligibility requirements.

Starter (Cash)

Globally diversified portfolios containing more than 8,000 stocks and 600 government bonds.

CPF

Digital portfolios available under the CPF Investment Scheme (CPFIS), allowing eligible CPF savings to be invested through AutoWealth.

SRS

Globally diversified portfolios made up of SRS-approved funds for investors using Supplementary Retirement Scheme (SRS) monies.

AutoWealth Plus+

Equity-focused portfolios investing in market-specific themes such as New Economies and Digital Economies. Charges a performance fee on net profits instead of an annual management fee.

Flexi Cash

Invests in money market funds or treasury bills. Designed for lower volatility and cash management.

Onboarding Process

- Complete online registration

- Verify identity digitally

- Select funding source (Cash, CPF or SRS)

- Fund your account

- Investments are deployed into your selected portfolio

A Saxo custody account is created under your legal name to hold your assets.

Viewing Your Saxo Custody Account

To access your holdings at Saxo Capital Markets, log in via:

Do not use the standard Saxo login page.

Final Thoughts

AutoWealth may suit investors who:

- Prefer globally diversified portfolios

- Want assets held under their own name

- Wish to invest using Cash, CPF or SRS

- Value transparent fee structures