How and where to start your investment journey?

Investing made easier with moomoo

Table of Contents

About moomoo powered by FUTU

In Singapore, capital markets products and services on moomoo are offered by Futu Singapore Pte. Ltd., an entity licensed and regulated by the Monetary Authority of Singapore (MAS) (Licence No. CM101000).

Customers can access a wide variety of financial products including:

- Stocks: United States (U.S.), Hong Kong, Singapore and China A market

- U.S. stock options

- Futures

- American Depositary Receipt (ADRs)

- Exchange Traded Fund (ETFs)

- Real Estate Investment Trust (REITs)

Corporate Background

Futu Singapore’s parent company, Futu Holdings Limited, is listed on NASDAQ and backed by world-class strategic investors which include venture capital affiliates of Tencent, Sequoia Capital and Matrix Partners.

Market Share

Futu Holdings Limited has 43 licenses globally in major financial markets such as United States, Hong Kong and Singapore.

It is a major player in the investment platform scene and has garnered over 16 million users from more than 200 regions around the world, boosting an average of more than one million active users daily.

In Singapore, moomoo is experiencing phenomenal growth in its client base since its launch in early 2021.

Excerpt from Mr. Leaf Hua Li’s (Futu’s Chairman and Chief Executive Officer) speech during Q2 2021 results announcement:

“The net addition of paying clients was approximately 211 thousand, our second-best quarter in history. We achieved the 1 million paying client milestone as of quarter end, representing 230.2% year-over-year growth.”

“We are encouraged to see that Singapore contributed to roughly half of this net addition, which underscores our product appeal and the huge untapped market opportunity in Singapore.”

Competitive Features

Compared against the competition, moomoo powered by FUTU stands out for:

- being reliable, secure, and stable: FUTU uses a self-developed proprietary trading system, which has been continuously honed for the past 9 years.

- offering competitive rates which includes 0 commission fees during promotion period.

- providing a seamless investing experience

Addressing the concerns of a beginner learning to invest

For newcomers, top reasons to procrastinate starting their investment journey include:

- not knowing much about investing in general.

- not knowing where and how to research trade ideas

- thinking that it is complex to create a trading account

- having limited investment capital

- protecting the investment funds

Read on to see how the moomoo platform helps to address these concerns.

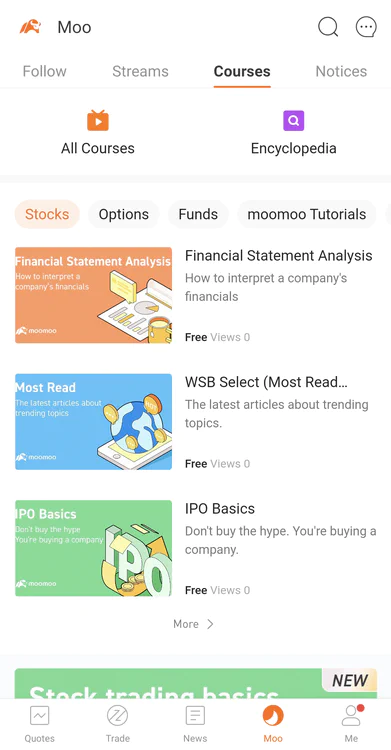

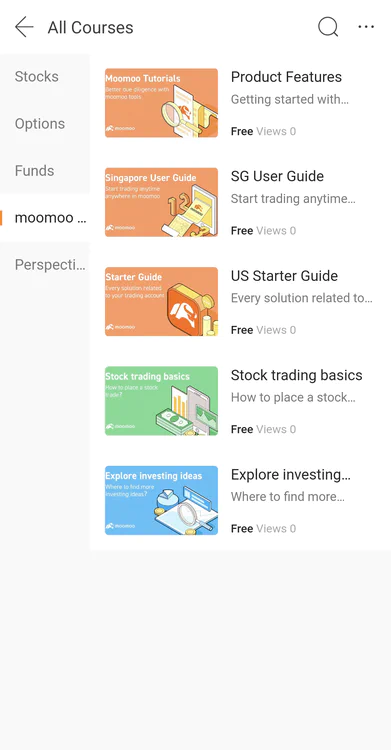

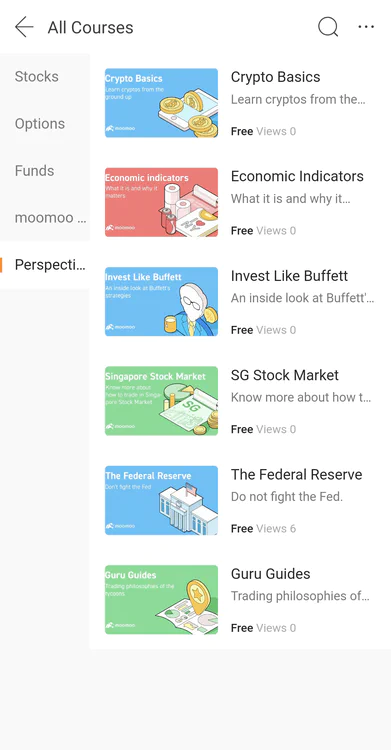

Free trading guides and courses available 24/7, even on-the-go

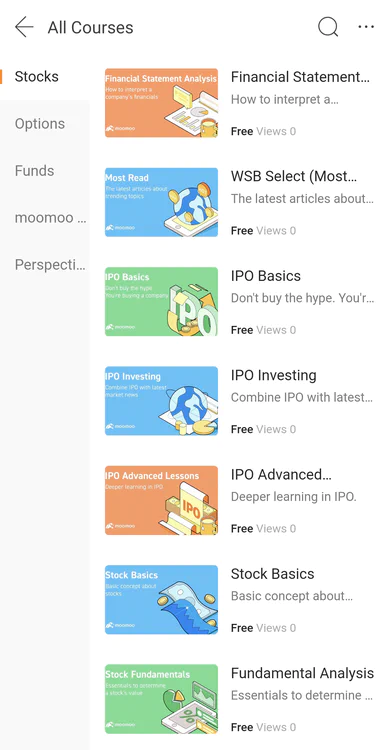

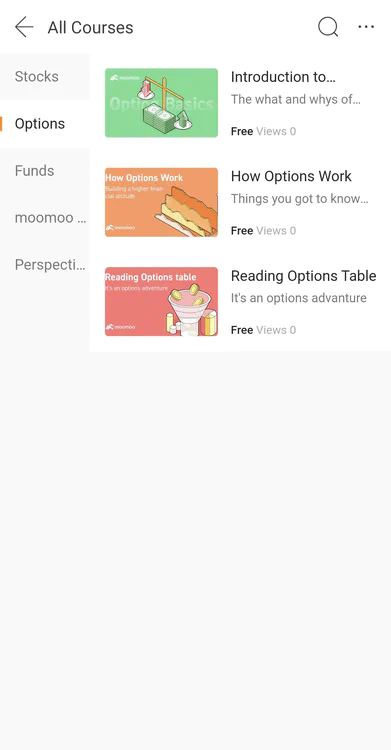

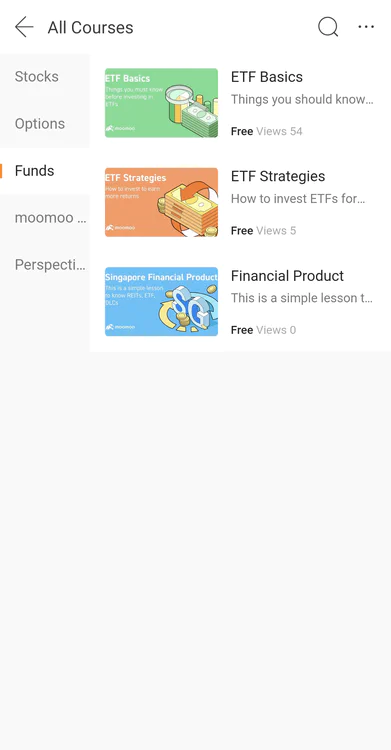

Within the moomoo app, if you navigate to the “Moo” tab -> “Courses”, there are more than 20 complete online courses and videos that covers across Stocks, IPOs, Options, ETFs for all customers. This is particularly useful for absolute beginners to learn about financial products, technical jargons, and general investment knowledge.

For beginners, recommended courses include:

- “Stocks” -> “Stock Basics”

- “Funds” -> “ETF Basics”

- “Funds” -> “Financial Product”

- learn about REITs, ETFs, and DLCs

- “moomoo Tutorials” -> “Product Features”

- learn how to add/delete stocks to a watchlist

- use the stock screener

- understand candlestick and stock trendlines

- understand transaction statistics

- paper trading simulator

- “moomoo Tutorials” -> “SG User Guide”

- How to deposit funds

- How to place orders on moomoo

- “moomoo Tutorials” -> “US Starter Guide”

- How to create a currency conversion request

- How to place/modify orders on moomoo

If you prefer watching videos, you can subscribe to the official moomoo Singapore Youtube Channel for video tutorials on some of the topics above too.

Ease of creating and funding a trading account

The moomoo platform is open to Singaporeans, Permanent Residents (PRs) and foreigner residing in Singapore who are above 18 years old. The process is simple and can be completed in minutes!

For Singaporean and PRs, refer to this video for account opening steps:

For foreigners residing in Singapore, refer to the following video instead:

After the trading account is successfully opened, the easiest option to fund SGD is through “Instant Deposit via Direct Debit Authorisation (DDA)”. This involves linking your POSB/DBS bank account to your FUTU SG securities account.

Paper trading

If you wish to explore more before committing to real cash investments, you can first create a paper trading account in the moomoo app. It is a great way for beginners to gain confidence.

For seasoned investors, it is a good way to test out your trading strategies.

A paper trade is a simulated trade that allows an investor to practice buying and selling without risking real money.Definition: Paper Trading

Competitive commissions

When I first started investing in 2007, the local brokerage market was dominated by a few local players. Minimum commission then was S$25 per trade. This made averaging down trades and diversifying difficult for a novice investor with limited capital.

Definition: Averaging Down

Average down (or averaging down) refers to the purchase of additional units of a stock already held by an investor after the price has dropped. Averaging down results in a decrease of the average price at which the investor purchased the stock.

Thankfully in 2021, this is no longer an issue. Futu SG offers some of the lowest fees and trading minimums in Singapore for investing in Hong Kong and U.S. securities, futures, and options.

In the U.S. markets where the lot size is just 1, it allows newbies to experiment buying shares with small amounts of capital and not have to worry about the commission.

FUTU SG is fully transparent with their charges, which is presented clearly in their fees schedule:

Please note that apart from the commission, trades have platform and regulatory fee components too.

These are payable even if you are enjoying a commission free trading promotion. For example, a trade in the Singapore stock in market would still incur:

- Platform Fees: 0.03% of transaction amount, minimum SGD 1.50 (payable to Futu)

- Trading fee: 0.0075% of transaction amount (payable to SGX)

- Clearing Fee: 0.0325% of transaction amount (payable to SGX)

“More than 70% of Futu’s employees worldwide are engaged in research and development (R&D) to improve the platform. The platform fees enable Futu to continue investing in technologies to improve the platform.”

Research and general public sentiment access

Most traditional brokerages only focus on the trading functionality. In addition to this, the moomoo app provides centralised information for market news, company performance and sentiment, and saves you from having to research across different platforms and websites.

Here are some key features:

- 24/7 updated headlines and news

- Filter popular stocks across stock markets under “Heat Lists” based on trading volume, search volume and news volume identify what is hot in the market

- Earnings Calendar

- Ratios and analysis

- Graphs and up to 29 chart patterns and drawing tools

- Company introductions, announcements, financial reports, live broadcast of earnings and conference calls

- Competitor research

- “Comments” section within the detailed information page for each company where the more than 16 million strong global moomoo community can share perspectives and insights with each other.

Live market data

Moomoo powered by FUTU provides value-added complimentary access to:

- Level 2 market data for the US market which displays real-time bids, asks and stock quotes

- Level 1 real-time SGX Securities SG market data and 24/7 aggregated updates

- Level 1 China A Shares market data which displays real-time bids, asks and stock quotes

On many other trading platforms, price information provided are typically lagging by 15 minutes and real-time information like these require a separate monthly or annual subscription fee.

Definition: Quote Levels

- Level 1 quotes provide basic price data for a security including the best bid and ask price + size on each side.

- Level 2 quotes provide more information than Level 1 quotes by adding market depth (the number of shares, or lots available at each individual price). It is commonly referred to as the order book, given it shows a range of orders that have been placed and are waiting to be filled.

- Day traders will generally use it in conjunction with technical analysis strategies or along with fundamental analysis. But it can be an additional form of analysis to help better inform trading decision-making.

- Level 3 quotes add greater market depth by providing up to 20 of the best bid and ask prices. These are primarily used by brokers and market makers.

Getting Help

Futu SG prides itself in putting users’ experience as a priority. Thus, customers enjoy 24 hours customer service on trading days for a peace of mind.

Within the moomoo app, you can use the in-app live chat function via “customer service” to get a customer service representative to attend to your questions.

Apart from the in-app “Help Center”, other ways to contact moomoo include their customer service line, email and social media platforms.

moomoo contact methods:

- In-app “Help Center”

- Email: clientservice@futusg.com

- Customer service line: +65 6321 8888 (Weekdays: 24 hours, Weekends: 9am – 9:30pm)

- Social media:

Unlike some foreign brokers without a physical presence in Singapore, it is reassuring to know that Futu Singapore Pte. Ltd. has an office in downtown Singapore.

Safety of investment funds

FUTU SG is regulated by Monetary Authority of Singapore. Apart from that, U.S. securities in your account are protected up to $500,000 by Securities Investor Protection Corporation (SIPC), explanatory brochure available at www.sipc.org.

Conclusion

moomoo powered by FUTU strives to be a one-stop shop for its clients. The resources available like investment courses, financial market news and discussion forum features are all there to help investors make informed investment decisions.

If you are new to investing, take some time to build up your financial literacy and understand basic investment principles. Also do your own due diligence to understand each financial product’s features and risks, and avoid speculating trades.

Sign-up now to enjoy Welcome Benefits!

If you have yet to sign up for your FUTU SG securities account, you can open your account via this referral link.

Check out the latest welcome benefits from our moomoo referral post.